From Cincinnati.com: Here’s $8,000 in coins

Jones, 70, said he has always kept his money in coins because he doesn’t trust banks or paper money.

“Paper money will burn, but it is hard to damage coins. I bought four or five rolls of coins each month. I don’t know how long it took me to save this amount, probably all my life, spending some of it now and then,” said Jones, who retired in 2003 as an engineer from Fort Hamilton Hospital’s maintenance department.

It took the dealership an hour and a half to count all the coins. But they didn’t have to accept coins as payment if they didn’t want to. Private businesses can choose to accept whatever form of payment they desire and could refuse someone who wanted to pay for something in all pennies.

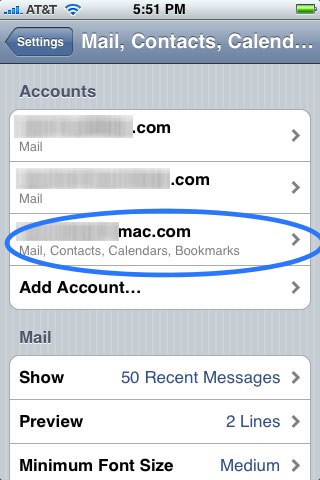

From Wikipedia:

The United States Coinage Act of 1965 states (in part):

United States coins and currency (including Federal reserve notes and circulating notes of Federal reserve banks and national banks) are legal tender for all debts, public charges, taxes and dues. Foreign gold or silver coins are not legal tender for debts.

31 U.S.C. § 5103.This statute means that all United States money as identified above are a valid and legal offer of payment for debts when tendered to a creditor. There is, however, no Federal statute mandating that a private business, a person or an organization must accept currency or coins as for payment for goods and/or services. Private businesses are free to develop their own policies on whether or not to accept cash unless there is a State law which says otherwise. For example, a bus line may prohibit payment of fares in pennies or dollar bills. In addition, movie theaters, convenience stores and gas stations may refuse to accept large denomination currency (usually notes above $20) as a matter of policy.[9]